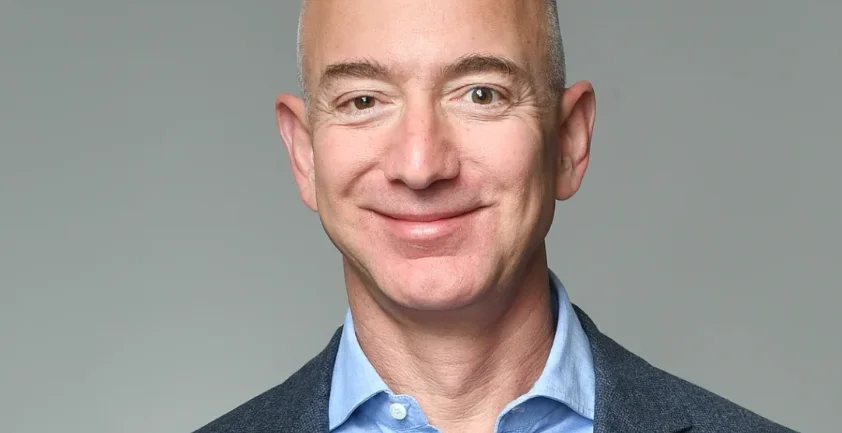

Bezos Compares AI Boom to Past Investment Bubbles

Amazon founder Jeff Bezos has warned that the current wave of enthusiasm surrounding artificial intelligence (AI) could be creating an investment bubble, as capital flows into both promising and unproven ventures.

Speaking to an audience recently, Bezos said that in periods of extreme excitement, such as the one AI is experiencing now, investors often fund “every experiment,” making it difficult to distinguish between solid ideas and weak ones.

“When people get very excited, as they are today, about artificial intelligence, every experiment gets funded, every company gets funded, the good ideas and the bad ideas,” Bezos explained. “Investors have a hard time in the middle of this excitement distinguishing between the two.”

AI Hype Mirrors Biotech and Dot-Com Booms

Bezos drew parallels between today’s AI frenzy and past episodes of market exuberance, notably the biotechnology bubble of the 1990s and the dot-com mania that followed.

While both periods saw investors lose large sums, they also laid the groundwork for transformative innovation.

“In the biotech bubble, a lot of companies went out of business and investors lost money,” Bezos said. “But we did get a couple of lifesaving drugs.”

“The internet bubble left behind the infrastructure for the modern digital economy,” he added.

According to Bezos, a similar dynamic is playing out now in artificial intelligence, where vast sums are being poured into both AI startups and the infrastructure that powers them, from chipmakers and cloud computing providers to large-scale data centres

AI Investments Reach Record Levels

The AI investment boom has led to record-breaking valuations across the technology ecosystem. Bloomberg recently reported that BlackRock’s Global Infrastructure Partners is nearing a deal to acquire Aligned Data Centres for about $40 billion, underscoring strong investor appetite for AI-related assets.

Meanwhile, OpenAI, the creator of ChatGPT, has become the world’s most valuable privately held company, following a secondary share sale that valued the firm at $500 billion.

Bezos noted that some companies are securing billions in funding before even demonstrating viable products, a hallmark of speculative market behaviour.

Bezos: AI Will Ultimately Transform Every Industry

Despite the risks of overinvestment, Bezos maintains a long-term optimistic outlook on artificial intelligence. He predicted that AI will eventually boost efficiency, productivity, and innovation across nearly every sector.

“AI is going to change every industry and improve the productivity of every company in the world,” Bezos said. “When the dust settles and you see who the winners are, society benefits from those inventions.”

Amazon’s Role in the AI Revolution

Amazon has positioned itself at the centre of the global AI transformation, investing heavily through Amazon Web Services (AWS) — the cloud platform powering many AI startups.

The company is also leveraging AI across its logistics operations, e-commerce systems, and Alexa voice assistant to enhance customer experience and efficiency.

For Bezos, these initiatives exemplify how market “bubbles” can accelerate technological progress, even if they temporarily inflate valuations.

“Bubbles may be painful for investors,” Bezos reflected, “but they also speed up the arrival of world-changing technologies. That’s what’s going to happen here, too.”

Key Takeaway

While Bezos warns of a potential AI investment bubble, he also underscores that technological revolutions often emerge from speculative excesses. As artificial intelligence continues to attract massive funding, the long-term winners both companies and societies, could emerge stronger and more advanced than ever before.