Cardoso to Fintech CEOs: Technology Innovation Must Be Matched by Strong Governance

Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has called on Nigerian fintech leaders to balance technological innovation with strong governance, consumer protection, and effective risk management.

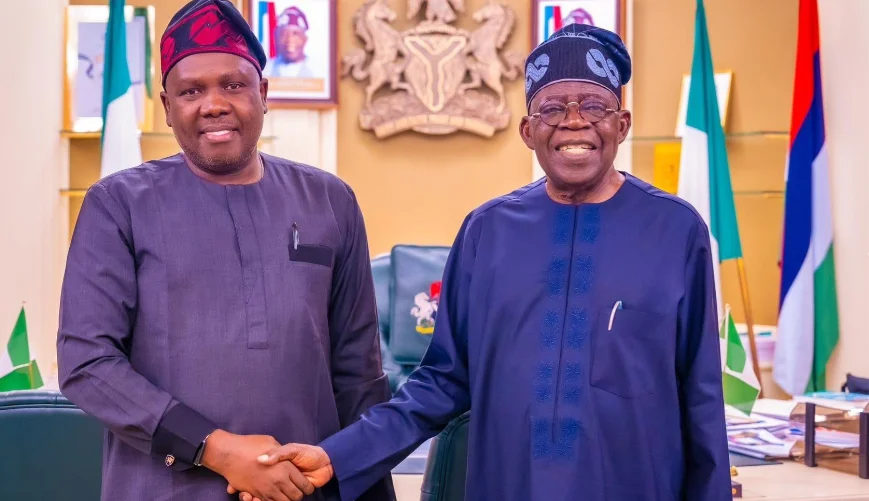

Speaking during a strategic session with fintech CEOs on the sidelines of the 2025 IMF/World Bank Annual Meetings in Washington, Cardoso reaffirmed the CBN’s commitment to fostering innovation in the financial sector — but with clear safeguards to preserve integrity and public trust.

“As we embrace new technology, it is our responsibility to uphold the integrity of the financial system, maintaining strong governance, consumer protection, and risk management so that trust in our institutions remains firm,” Cardoso said.

Balancing Innovation and Stability

The closed-door session, themed “Shaping the Future of Fintech in Nigeria: Innovation, Inclusion, and Integrity,” gathered fintech founders, investors, regulators, and policy leaders across Nigeria’s digital finance ecosystem.

The engagement provided a platform for the CBN to better understand emerging industry trends and challenges while exploring policy frameworks that strike a balance between innovation and financial stability.

Cardoso emphasised that collaboration and open dialogue between the CBN and fintech stakeholders are vital to shaping policies that encourage sustainable growth and protect consumers.

“At the CBN, we are committed to creating an environment where new ideas can flourish under prudent oversight, and where inclusion is at the heart of our endeavours,” he added.

Key Focus Areas for Policy Alignment

According to a statement from the CBN’s official X handle, discussions at the session revolved around five priority areas critical to Nigeria’s fintech growth:

- Innovation and Responsible Growth

- Infrastructure and Interoperability

- Legal and Policy Enablement

- Compliance and Financial Integrity

- Market Confidence and Sustainable Capital Flows

Stakeholders agreed that achieving a balanced regulatory environment, one that supports innovation while safeguarding market confidence, is essential to unlocking Nigeria’s full fintech potential.

A Commitment to Continuous Engagement

The session concluded with a joint commitment between the CBN and fintech leaders to sustain continuous engagement and align regulatory reforms with Nigeria’s broader financial innovation agenda.

This renewed collaboration signals a strategic step toward building a resilient, inclusive, and innovative fintech ecosystem, one that drives economic growth while protecting the stability and integrity of Nigeria’s financial system.