PalmPay, a leading African neobank and fintech platform, has been named the fastest-growing financial services company in Africa and ranked #2 overall in the Financial Times Africa’s Fastest-Growing Companies 2025 list, compiled in partnership with Statista.

This prestigious ranking evaluates Africa-based companies based on compound annual growth rate (CAGR), revenue, operational expansion, and user acquisition. From 2020 to 2023, PalmPay recorded an impressive CAGR of 583.6%, driven by its rapid scale-up of tech-enabled financial services in Nigeria.

Over 35 Million Users and 15 Million Daily Transactions

As of 2025, PalmPay has surpassed 35 million registered users, with over 15 million transactions processed daily, cementing its role as a key driver in Africa’s digital financial revolution.

“The Financial Times’ recognition of PalmPay as Africa’s fastest-growing fintech is a powerful validation of our approach to closing financial access gaps in underserved markets.”

— Sofia Zab, Founding Chief Marketing Officer, PalmPay

What Sets PalmPay Apart?

PalmPay’s rapid growth is fuelled by its hybrid fintech model, combining a user-friendly superapp with an offline network of over 1 million agents and merchants across Nigeria, Ghana, Tanzania, and Bangladesh.

Key Offerings Include:

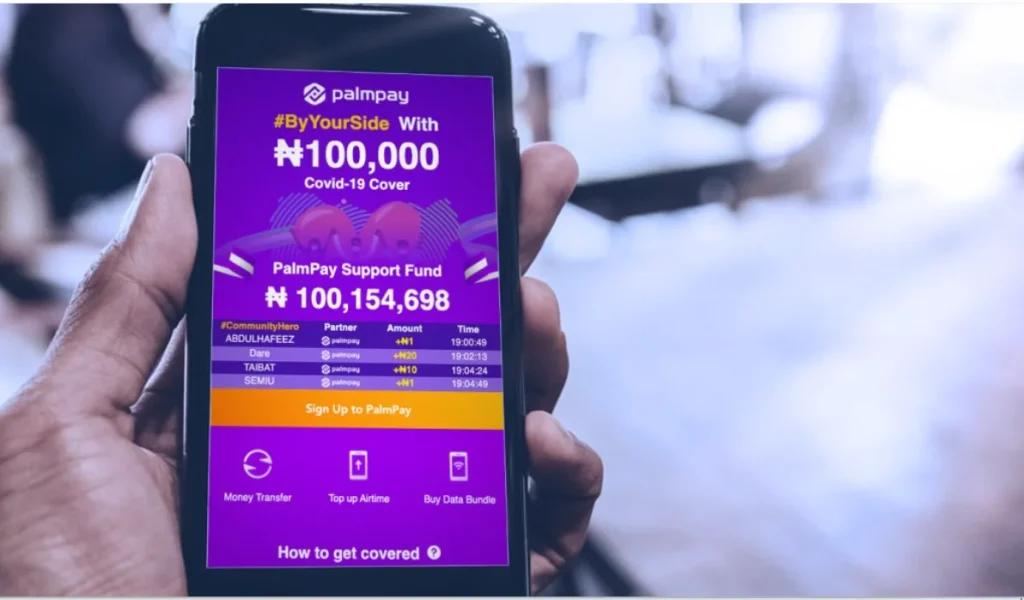

- Seamless money transfers

- Merchant payments

- Digital credit and savings products

- Microinsurance

- B2B payment solutions for local and global merchants

- Financial tools for MSMEs

Its mobile-first strategy has proven successful in onboarding underbanked and unbanked populations, with 25% of users reporting PalmPay as their first-ever financial account.

Empowering Africa’s Digital Economy

PalmPay’s success reflects its commitment to building a connected African economy through digital finance innovation, accessibility, and regional partnerships.

“Our vision is to empower businesses and individuals with frictionless, reliable financial tools. We’re deepening partnerships to enhance infrastructure and scale digital inclusion.”

— Jiapei Yan, Group Chief Commercial Officer, PalmPay

The company’s initiatives in cashless payments, financial literacy, and infrastructure development continue to accelerate financial inclusion, particularly in remote and underserved communities.

Financial Inclusion Meets High-Frequency Engagement

PalmPay’s users complete an average of 50+ transactions per month, utilising services ranging from everyday purchases to long-term financial planning tools like yield-bearing savings and microinsurance. This high level of engagement highlights PalmPay’s effectiveness in delivering consistent value while also showcasing the platform’s ability to retain and scale its user base across multiple markets.

By earning the #2 spot in the Financial Times Africa’s Fastest-Growing Companies 2025, PalmPay has solidified its position as a fintech powerhouse in Africa. With continuous investment in technology, customer experience, and inclusive growth, PalmPay is poised to lead the next phase of digital transformation across emerging markets.