FairMoney Disburses ₦150bn Loans, Pays ₦7bn Interest in One Year

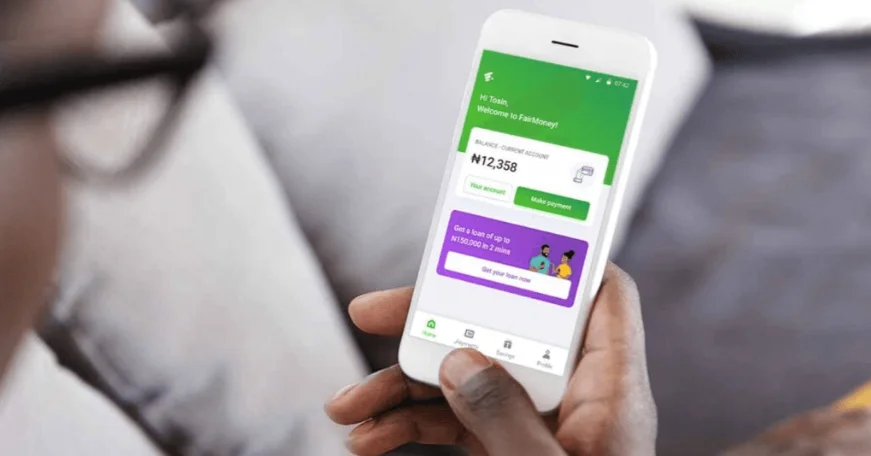

Nigerian fintech bank FairMoney has disclosed that it disbursed more than ₦150 billion in loans over the past year, while paying out over ₦7 billion in interest to savings customers during the same period.

The figures underline FairMoney’s expanding footprint in Nigeria’s financial services sector, particularly in digital lending and savings products targeted at underserved individuals and businesses.

From Digital Lender to Licensed Microfinance Bank

FairMoney Microfinance Bank began operations in 2021 as one of Nigeria’s early platforms focused on rapid, digital access to credit.

Since then, the institution has scaled into a fully licensed microfinance bank, broadening its offerings beyond short-term loans to include:

- High-interest savings accounts

- Fixed-term deposits

- Current accounts

- Debit cards

- POS and merchant payment solutions

These services are designed to support financial inclusion by combining ease of access with competitive pricing.

Technology-Driven, Collateral-Free Lending

As a technology-enabled bank, FairMoney uses artificial intelligence and machine learning to analyse financial and alternative data, including smartphone usage patterns and customer-provided information.

This approach allows the bank to generate proprietary credit scores, enabling fast, collateral-free loans for individuals and small businesses often excluded from traditional banking systems.

By assessing creditworthiness beyond conventional metrics, FairMoney says it is widening access to finance for underserved segments of the population.

MD: Loan and Savings Growth Reflect Deeper Financial Impact

Commenting on the performance, Henry Obiekea, Managing Director of FairMoney MFB, said the numbers reflect more than financial growth.

“Our record loan disbursements and savings pay-outs over the past year are more than just numbers; they represent our unwavering tenacity in supporting the Nigerian financial ecosystem,” Obiekea said.

“At FairMoney, we are driven by the knowledge that our platform provides essential capital for individuals to thrive and for businesses to scale.”

He added that the bank’s savings products are designed to offer inflation-beating returns, helping customers preserve wealth in a challenging economic environment.

Regulatory Compliance and Customer Protection

FairMoney operates as a Central Bank of Nigeria-licensed institution and complies fully with CBN regulations. Customer deposits are insured by the Nigeria Deposit Insurance Corporation, while data protection and security are maintained in line with the Nigeria Data Protection Regulation (NDPR) and bank-grade cybersecurity standards.

Aligned With Nigeria’s Cashless and Digital Payments Push

The bank’s growth comes amid Nigeria’s broader transition toward a cashless economy under the CBN’s Payment Systems Vision 2025 framework.

By October 2025, electronic payments in Nigeria reached record levels, with instant bank transfers accounting for nearly 70% of all e-payment transactions.

FairMoney said it contributed to this shift by facilitating large-scale digital loan disbursements and savings interest payments, reinforcing its role as a conduit within the country’s digital financial infrastructure.

Looking Ahead to 2026

Obiekea said FairMoney remains focused on strengthening financial inclusion and customer trust as it enters the new year. “Our efforts in 2025 were defined by an unwavering commitment to inclusivity and a customer-centric mission rooted in fairness, empowerment, and confidence,” he said. “As we move into 2026, we remain resolute in driving the continued growth and resilience of Nigeria’s financial landscape.”