LemFi Launches in Egypt to Meet Growing Demand for Affordable International Transfers

LemFi, a leading global international payment service provider, has announced its official expansion into Egypt, enhancing access to fast, secure, and affordable remittance services across North Africa.

This strategic move adds Egypt to LemFi’s rapidly growing network of 30+ international payment destinations, including Morocco and Tunisia, further solidifying its presence in key African remittance corridors.

Why Egypt? A Critical Global Remittance Market

Egypt stands as one of the top remittance-receiving countries in the world. In 2024 alone, Egyptians received $20.6 billion in remittances—nearly double the previous year’s total. This upward trend signals a powerful opportunity for platforms like LemFi to bring innovation, transparency, and cost-efficiency to users sending money home.

“Whether in LemFi’s existing markets or new ones, the Egyptian diaspora is significant and they deserve a quality service like the one we offer.”

— Philip Daniel, Head of Global Expansion and Growth, LemFi

Empowering the Egyptian Diaspora in the UK, Canada & Europe

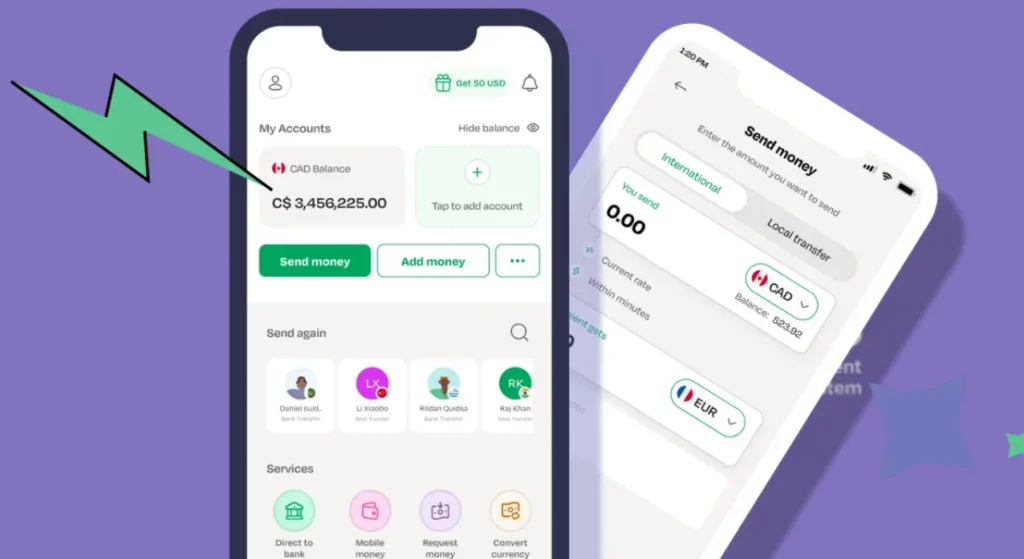

LemFi’s entry into the Egyptian market is particularly beneficial for the Egyptian diaspora in the UK, Canada, Europe, and other high-remittance regions. These users can now enjoy:

- Instant international money transfers

- Competitive exchange rates

- Zero hidden fees

- User-friendly mobile app access

The move ensures that Egyptians abroad can send money home with greater peace of mind, speed, and financial efficiency.

LemFi’s Mission: Making Cross-Border Payments Seamless and Affordable

With over 2 million global users, LemFi continues to revolutionise cross-border payments in Africa and beyond. The company’s expansion into Egypt aligns with its broader goal of financial inclusion, enabling individuals and families to receive money without the burden of excessive fees or delays.

LemFi also leverages advanced compliance and security technologies to ensure each transfer is protected and meets global financial regulations.

What’s Next for LemFi in North Africa?

As LemFi grows its footprint, it is expected to explore additional remittance corridors in North and Sub-Saharan Africa, building partnerships and enhancing infrastructure to support real-time international payments.

LemFi Egypt Launch Reinforces Commitment to Global Remittance Access

LemFi’s launch in Egypt is more than an expansion—it’s a bold step toward democratizing access to reliable and low-cost money transfers for millions. As remittance needs increase and digital finance adoption accelerates, platforms like LemFi are proving essential to connecting families, supporting local economies, and simplifying international financial flows.