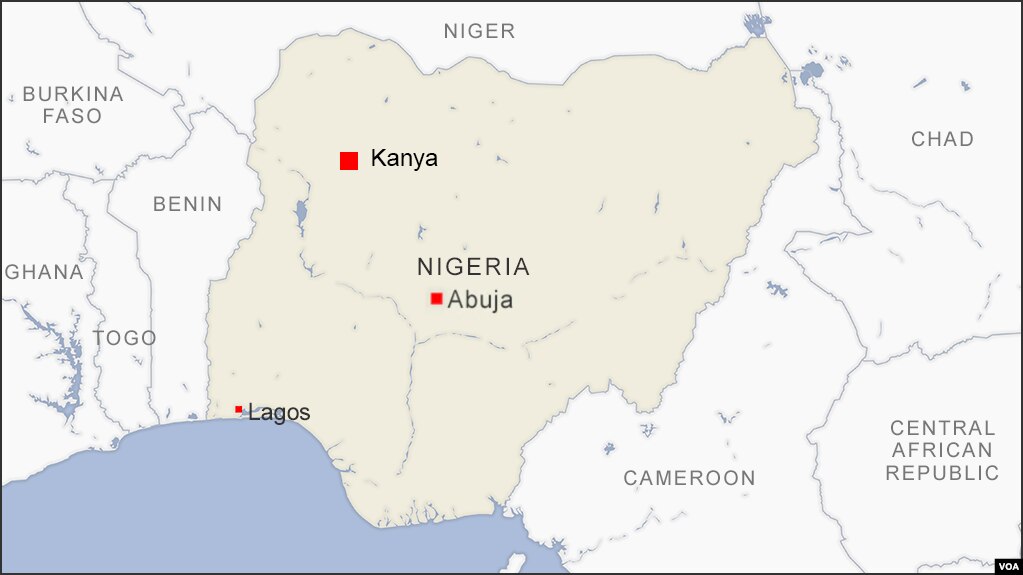

Abuja, Nigeria — Nigeria’s tech startup ecosystem is gaining global attention as a hotbed for innovation and investment, with companies like CrowdForce leading the charge. In February, the Nigerian startup secured $3.6 million in funding to expand its financial services, signalling the country’s growing role as a destination for Africa’s most promising technology ventures.

CrowdForce, co-founded by CEO Tomi Ayorinde, plans to use the funding to expand its mobile agent network from 7,000 to 21,000 agents by the end of the year, aiming to provide better access to financial services in underserved communities.

“We want to scale faster and capture more market share,” said Ayorinde. “Our work isn’t just about business; it’s about impact. We’re creating jobs and giving people opportunities to earn extra income in their communities, which is why impact investors are eager to join us.”

A Pivot to Solve Real Problems

Initially launched seven years ago as a data collection company, CrowdForce shifted its business model after identifying a significant gap in financial inclusion. Ayorinde and his team found that millions of traders lacked access to banking services or struggled to access funds through traditional financial systems.

“We collected data on 4.5 million traders and saw a massive problem: many had no bank accounts, and those who did couldn’t easily access cash,” Ayorinde explained. “That’s when we realized we could address a much larger issue.”

Nigeria’s Leadership in Africa’s Tech Revolution

CrowdForce is part of a broader trend across Africa, where technology startups are working to close the financial inclusion gap. According to a report by the African Private Equity and Venture Capital Association (AVCA), African startups attracted $5.2 billion in venture capital in 2022, with West Africa—led by Nigeria—capturing the largest share of investments.

Alexia Alexandropoulou, AVCA’s research manager, emphasized that Africa’s youthful population is a significant driver of investor interest. “Africa has the world’s youngest population, and as skilled labour increases, it boosts human capital for businesses and drives industrial development,” she said.

Nigeria’s leadership in the tech space is further supported by increasing internet penetration, improved government policies, and a thriving fintech sector that has captured the attention of global investors.

Challenges Amid Opportunity

Despite its growing prominence, Nigeria’s tech ecosystem faces hurdles. Louis Dike, a fintech digital marketing expert, highlighted issues such as regulatory inconsistencies and weak currencies.

“Africa is still made up of virgin markets, and while the opportunities are vast, challenges persist,” said Dike. “Government policies can be unpredictable, and startups often face obstacles that hinder consistent growth.”

Yet, the resilience of Nigeria’s tech community continues to shine. With new talents entering the field and innovative startups emerging across various sectors, the ecosystem shows no signs of slowing down.

A Bright Future for Nigerian Startups

As startups like CrowdForce expand their reach and investors pour into Nigeria’s vibrant tech scene, the country is solidifying its position as a leader in Africa’s digital transformation. With a youthful workforce, supportive policies, and a commitment to addressing critical challenges, Nigeria’s tech ecosystem is poised for sustained growth.

This momentum reflects a broader shift toward a more inclusive, technology-driven economy—one where Nigerian startups are not just solving local problems but setting standards for innovation across the continent.