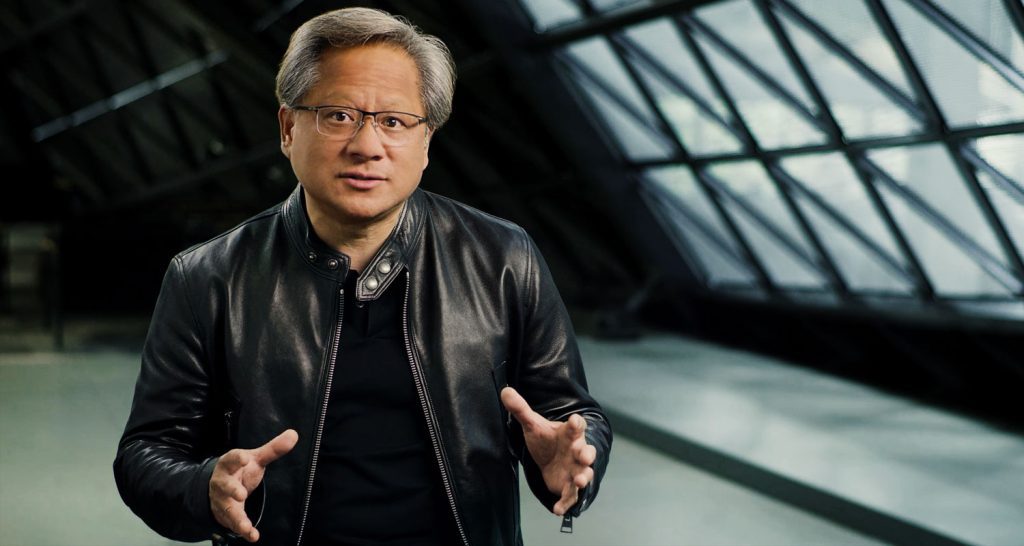

New Trade Worries Spark Drop

Nvidia’s stock took a notable hit this week, falling 5.7%—its second-biggest decline in March. The drop followed reports that the U.S. government may impose stricter regulations on semiconductor exports to China, a move that would directly impact Nvidia’s international revenue streams.

A Sector Already Under Pressure

The news landed during a rocky time for the tech sector. With rising interest rates, economic uncertainty, and cautious investor sentiment, many tech stocks have already seen sharp pullbacks. Nvidia, given its global exposure and reliance on sensitive supply chains, found itself right in the middle of this storm.

Data Center Slowdown Adds Weight

On top of regulatory concerns, Nvidia is facing slowing demand in one of its most lucrative segments: data centers. Enterprises are tightening budgets and delaying infrastructure upgrades, putting downward pressure on Nvidia’s short-term growth prospects—even as long-term AI demand remains strong.

“This is a perfect storm,” said a tech analyst. “Nvidia is still a leader, but right now, it’s feeling every wave of uncertainty.”

Long-Term Picture Still Strong

Despite the turbulence, many long-term investors are holding firm. Nvidia’s innovation engine remains strong, with AI hardware, autonomous systems, and deep learning continuing to fuel its R&D roadmap. For some, the current dip is just a temporary correction—not a structural threat.

A Test of Resilience

Ultimately, this moment represents a test for Nvidia—not just financially, but strategically. Can the company continue to lead amid tightening regulations and shifting market dynamics? Its track record suggests yes, but the road ahead will require sharp focus, smart pivots, and continued execution under pressure.