Nvidia has officially entered record-breaking territory, briefly reaching a market valuation of $3.92 trillion on Thursday—making it, for a moment, the most valuable company in history. This milestone reflects the booming investor confidence in artificial intelligence (AI) and Nvidia’s dominance in the AI chip market.

Nvidia Surpasses Apple’s Record Market Cap

Shares of Nvidia rose by 2.4% to $160.98 in early trading, pushing its market cap above Apple’s record of $3.915 trillion set in December 2024. Nvidia’s lead in high-performance AI chips has propelled it to the forefront of the global tech industry.

- Microsoft followed closely behind with a valuation of $3.7 trillion after a 1.7% increase in its stock price.

- Apple remained in third place with a $3.19 trillion market cap, up 0.8% on the day.

AI Boom Drives Demand for Nvidia Chips

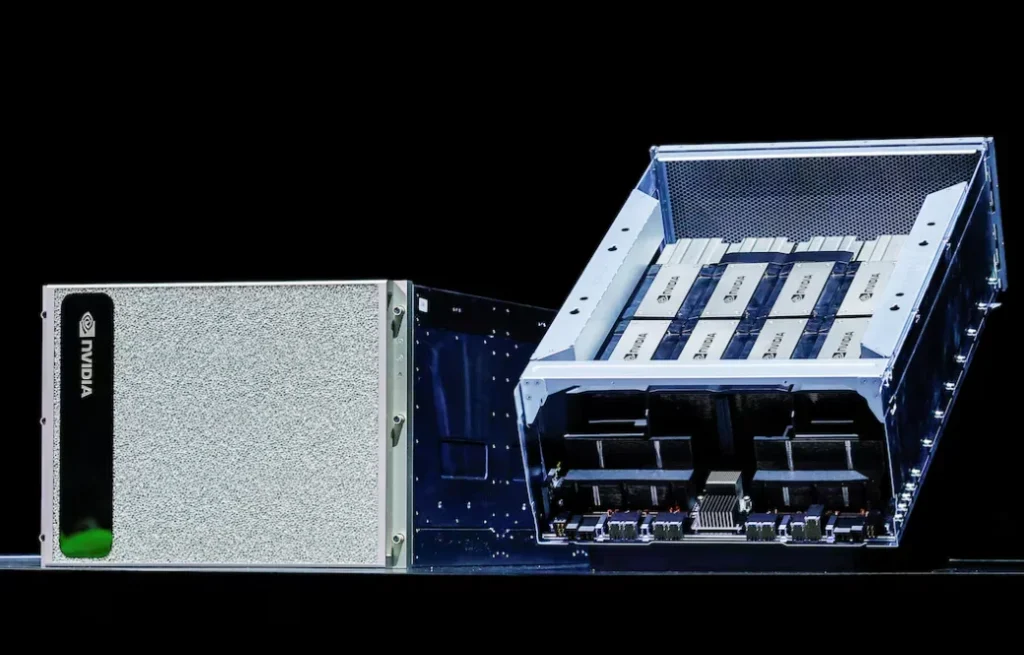

Nvidia’s rapid rise is driven by soaring demand for its cutting-edge GPUs, used in training the world’s most complex generative AI models. As tech giants like Microsoft, Amazon, Meta, Alphabet, and Tesla pour billions into building AI data centres, Nvidia remains the supplier of choice for powerful computing hardware. “When the first company crossed a trillion dollars, it was amazing. Now you’re talking four trillion—it’s incredible,” said Joe Saluzzi, co-manager of trading at Themis Trading. “It tells you there’s this huge rush with AI spending and everybody’s chasing it.”

Nvidia’s Value Surpasses Entire Stock Markets

Nvidia’s valuation is now greater than the entire public markets of Canada and Mexico combined, and even surpasses the entire UK stock exchange, according to data from LSEG.

From a valuation of $500 billion in 2021, Nvidia has grown nearly eightfold in just four years, illustrating the magnitude of its success in the AI era.

Valuation Remains Strong Despite Rapid Growth

According to LSEG, Nvidia is currently trading at 32 times expected earnings over the next 12 months, which is below its five-year average of 41. This indicates that rising earnings estimates are helping justify its stock price surge.

The company has rebounded over 68% from its recent low in April, recovering alongside other tech stocks after the market was rattled by President Donald Trump’s tariff announcements. Expectations of upcoming trade deals have helped stabilize investor sentiment.

Nvidia Now Powers the S&P 500

Nvidia now accounts for 7% of the S&P 500 Index, underlining the extent of its influence on the broader U.S. stock market. Alongside Microsoft, Apple, Amazon, and Alphabet, these five tech giants now make up 28% of the entire S&P 500—a massive concentration of market power centred on AI innovation.

Conclusion

Nvidia’s historic climb to a $3.92 trillion market cap is a clear reflection of the AI revolution reshaping global markets. As investors and companies race to capitalize on this trend, Nvidia’s position as the AI chip leader places it firmly at the heart of the transformation.