Nvidia is preparing to launch a new, lower-cost AI chip for the Chinese market, following tightened U.S. export controls that restricted the sale of its advanced H20 GPU. Sources familiar with the matter reveal that mass production of the new Blackwell-architecture GPU could begin as early as June 2025.

Cheaper Nvidia AI Chip Designed for Compliance

The upcoming AI processor, tailored for the Chinese data centre market, is expected to cost between $6,500 and $8,000, significantly undercutting the $10,000-$12,000 H20 GPU, which is now banned in China. The lower price point reflects the chip’s reduced specifications, simplified manufacturing process, and compliance with new U.S. export regulations.

This chip will reportedly be based on Nvidia’s RTX Pro 6000D, a server-class graphics processor, and will utilise GDDR7 memory instead of high-bandwidth memory (HBM). Furthermore, it will not feature TSMC’s advanced CoWoS packaging technology, aligning it with U.S. export restrictions that limit capabilities like memory bandwidth.

New Blackwell Chip Aims to Retain Nvidia’s Market Share in China

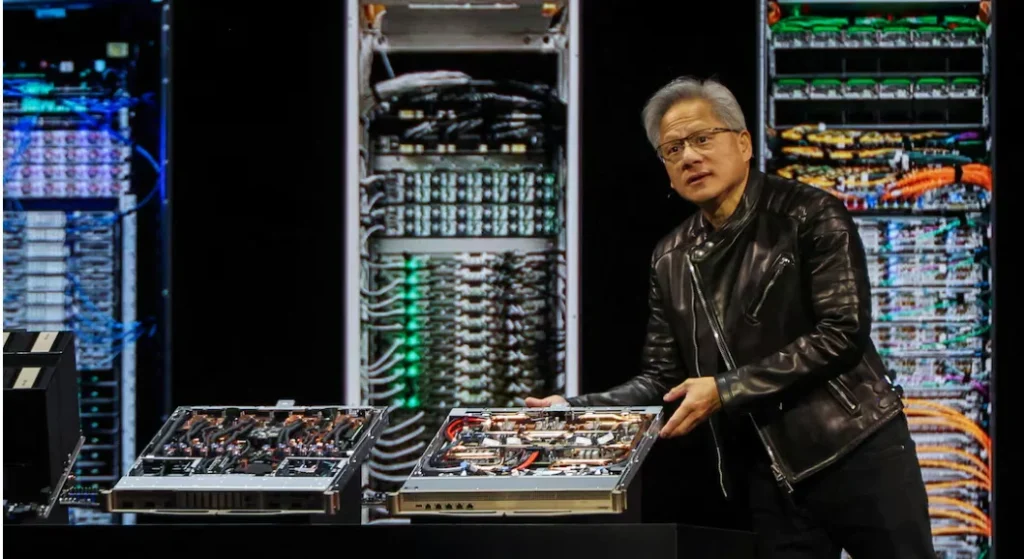

Despite a weaker computing power profile compared to the H20, this new Blackwell AI chip is designed to help Nvidia stay competitive in China’s $50 billion data centre market. According to industry sources, this launch will mark the third time Nvidia has developed a custom chip specifically for China, adapting to ongoing U.S. sanctions aimed at curbing Chinese technological advancements. Nvidia’s share in the China GPU market has fallen sharply from 95% in 2022 to 50% today, as per CEO Jensen Huang, who recently addressed the situation during a press event in Taipei.

CUDA Ecosystem Remains Nvidia’s Strategic Advantage

Despite increasing competition from domestic Chinese firms like Huawei, which manufactures the Ascend 910B chip, Nvidia retains an edge with its proprietary CUDA programming platform. CUDA remains widely used by developers building AI models and applications, anchoring Nvidia’s relevance in AI workloads.

Nori Chiou, investment director at White Oak Capital Partners, noted, “Nvidia’s edge lies primarily in its ability to integrate AI clusters with its CUDA platform.” However, he cautioned that Chinese firms may catch up within one to two years, especially with the growing pressure from U.S. restrictions.

Second Blackwell AI Chip for China in Development

In addition to the June-bound GPU, sources reveal that Nvidia is developing another Blackwell chip variant, which may enter production by September 2025. While specifications for this chip remain undisclosed, it underscores Nvidia’s strategic push to retain its presence in China amid intensifying regulatory challenges.

Export Curbs Prompt Major Financial Impact

The ban on the H20 GPU forced Nvidia to write off $5.5 billion in inventory and forgo $15 billion in sales, CEO Huang revealed on the Stratechery podcast. The latest U.S. regulations introduced a cap on GPU memory bandwidth, now restricted to 1.7-1.8 terabytes per second, compared to the H20’s 4 TB/s capacity. Chinese brokerage GF Securities speculates the upcoming chip could be named 6000D or B40 and estimates its memory bandwidth will reach the 1.7 TB/s limit, made possible using GDDR7 memo

Nvidia Navigates Export Barriers with Strategic Innovation

Nvidia’s upcoming Blackwell GPU for China reflects a strategic pivot to maintain competitiveness in a market increasingly dominated by local players like Huawei. While performance trade-offs are evident due to U.S. export rules, the combination of lower price, CUDA ecosystem support, and a tailored architecture could help Nvidia retain a foothold in China’s evolving AI landscape