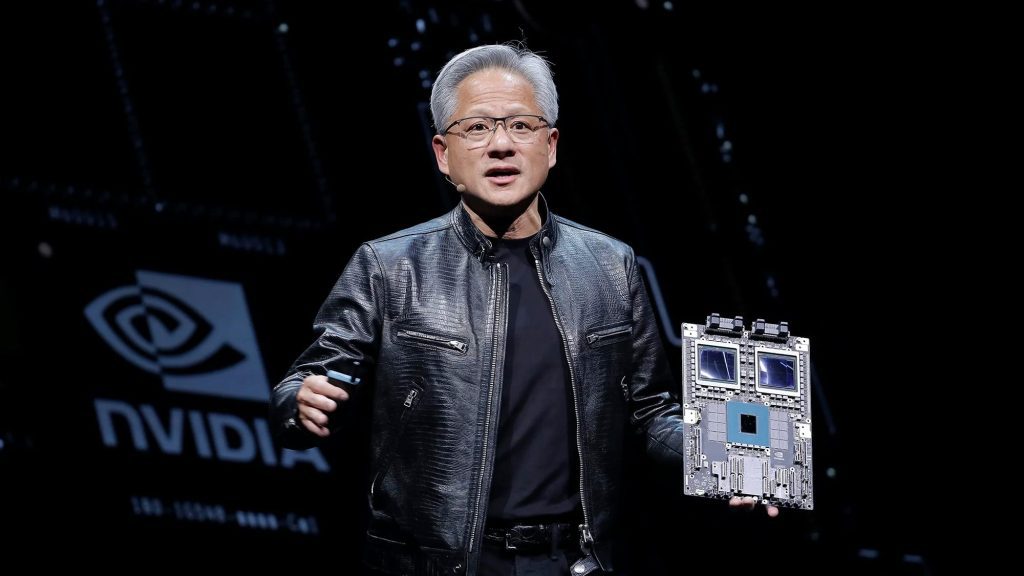

Jensen Huang, the billionaire founder and CEO of Nvidia, witnessed his wealth skyrocket by $6.6 billion on Tuesday, pushing his total net worth to an estimated $92.3 billion. The sharp rise in fortune came on the heels of a volatile stretch in the stock market, which had been rattled by sweeping new global tariffs introduced by the Trump administration earlier in April.

Huang’s windfall was fueled by a strong performance from Nvidia stock (NVDA), which surged as much as 7% in early trading. This uptick continued a recovery trend that began on Monday, when the stock gained 3.5%. Nvidia’s rally helped lead a broader resurgence across the “Magnificent Seven,” the elite group of major U.S. tech companies that includes Apple, Microsoft, Google, Amazon, Meta, and Tesla.

Trump’s Tariff Policy Sends Shockwaves Through Tech

The backdrop to this rebound is a significant shift in global trade policy. On April 2, President Donald Trump announced a two-pronged tariff plan aimed at reshaping the international trading landscape. The first part—a universal 10% tariff on all global imports—took effect over the weekend. The second component, a “reciprocal tariff” plan, is designed to match and retaliate against any country that imposes higher tariffs on American exports.

This sweeping policy overhaul immediately sparked panic on Wall Street. The technology sector, with its heavy dependence on international supply chains, was particularly hard-hit. Within days, a staggering $1.8 trillion in market capitalization was wiped out from major tech firms, triggering sharp declines across leading stocks and unsettling global investor confidence.

Nvidia’s Unique Position in the Tariff Crossfire

Among the companies most exposed to these trade tensions is Nvidia, the Silicon Valley semiconductor powerhouse that dominates the AI chip market. Nvidia’s cutting-edge GPUs are manufactured and assembled through a complex international network, including facilities in China and Taiwan—two regions now at the heart of U.S. and Chinese tariff crossfire.

China responded to the U.S. tariffs with retaliatory duties of its own, further escalating the trade dispute. This bilateral tension places companies like Nvidia in a difficult position, as they face rising costs and potential disruptions from both directions of the supply chain.

However, despite these looming challenges, investor sentiment around Nvidia has rebounded—at least in the short term. One critical reason behind this renewed optimism is that Nvidia’s AI-focused server equipment, which is produced in Mexico, remains exempt from the new import tariffs thanks to provisions under the United States-Mexico-Canada Agreement (USMCA).

This strategic production choice has shielded some of Nvidia’s most profitable product lines from the immediate financial impact of Trump’s tariff move. Bernstein Research analyst Stacy Rasgon identified this exemption as a significant reason for the company’s stock recovery this week.

Tech Titans Join the Rally

Nvidia’s comeback sparked momentum across the broader technology sector. Meta (formerly Facebook) posted a 6% gain on Tuesday, while Tesla climbed just over 5%. Amazon’s shares advanced nearly 5%, Microsoft rose approximately 4%, and Alphabet (Google’s parent company) and Apple each saw gains exceeding 2%.

These collective rebounds provided a partial reversal to the market carnage that had unfolded the previous week. Still, the underlying volatility suggests that investor confidence remains fragile, especially with geopolitical uncertainties and trade battles continuing to unfold.

Lingering Concerns Over Global Supply Chains

Despite the temporary surge in share prices, analysts and industry observers are cautioning against overly optimistic interpretations. The long-term ramifications of the new trade policies are far from clear. Key concerns persist around global supply chain stability, rising production costs, and potential retaliatory measures from other nations.

Apple, for example, manufactures nearly 90% of its iPhones in China, making it particularly vulnerable to retaliatory tariffs and logistic complications. Tesla’s global operations also rely heavily on parts sourced from international suppliers. Similarly, Nvidia’s intricate web of chip production spans multiple countries and vendors, each of which could be impacted differently by evolving trade regulations.

If the tit-for-tat tariff exchanges between the U.S. and its trading partners intensify, production timelines could be delayed, costs could rise sharply, and profitability across the tech sector could take a substantial hit. Companies that rely on precision manufacturing and just-in-time inventory systems may find it especially difficult to navigate prolonged trade tensions.

A Moment of Relief for Jensen Huang

In the midst of this uncertainty, Jensen Huang’s Tuesday windfall stands out as a testament to both the resilience of Nvidia’s AI business and the unpredictable nature of financial markets. In less than 48 hours, Huang went from weathering a tech-sector meltdown to seeing one of the largest single-day increases in billionaire wealth in 2025.

It’s a stark reminder of how fast fortunes can shift in the high-stakes intersection of technology and geopolitics. Nvidia’s continued success will likely hinge on how it adapts to evolving trade dynamics, maintains supply chain resilience, and continues to dominate in the competitive AI hardware market.

While short-term gains have brought relief to investors, the road ahead remains fraught with challenges. Tech companies will need to diversify production bases, hedge against geopolitical risks, and build more agile supply chains to withstand the shocks of a reshaped global trade order.

Looking Ahead

The current rebound offers a temporary breather for Nvidia and the tech sector at large, but the effects of Trump’s aggressive tariff strategy are only beginning to play out. With the second phase of reciprocal tariffs still to be implemented and other countries formulating their responses, markets may be entering a prolonged period of heightened volatility.

In the meantime, industry leaders like Jensen Huang are likely to stay in the spotlight—not only for their business achievements but for how their companies navigate an era of renewed economic nationalism. The next few months will test Nvidia’s agility in managing costs, preserving growth, and defending its market position amid an increasingly fragmented global economy.