Tesla’s investors will be closely watching CEO Elon Musk this Tuesday as the electric carmaker unveils its latest financial results. At the top of their minds are two critical questions: when will Tesla release its long-promised budget-friendly vehicle, and is the much-hyped robotaxi initiative still on track?

Wall Street’s optimism hinges heavily on Tesla launching a lower-cost car—a move expected by the middle of the year. This model is seen as essential to reignite consumer demand after recent sales declines, which have been worsened by intensifying competition and public backlash tied to Musk’s outspoken political views.

An exclusive report revealed last Friday that Tesla’s plan includes a pared-down variant of the Model Y, the company’s top-selling SUV, to be produced in the U.S. However, internal delays have reportedly pushed back the timeline for its release.

“The budget Tesla could be the spark that reverses the current downtrend. But if it turns out to be a no-frills version of the Model Y, the market might be underwhelmed,” said Will Rhind, head of asset management firm GraniteShares. “Elon needs to deliver both on timing and product expectations.”

Shrinking Margins, Slowing Sales

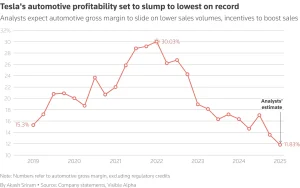

Tesla is in urgent need of a turnaround. As vehicle sales have declined, so have the company’s profit margins. Analysts project that Tesla’s automotive gross margin in the first quarter dropped to its lowest level in recent memory. Many expect this pressure to persist as the automaker continues rolling out incentives to support its flagging sales.

The company has mentioned that leveraging its existing vehicle platforms and manufacturing infrastructure for the new, cheaper car will reduce costs. However, further specifics remain scarce.

With demand slowing for Tesla’s aging fleet—and Chinese EV makers gaining traction across Europe and China—Musk shifted focus last year to autonomous vehicles and artificial intelligence. He vowed to introduce a driverless ride-hailing service, initially in Texas by mid-2025, followed by California later in the year.

But this pivot has raised alarms. For nearly ten years, Musk has repeatedly claimed that fully self-driving Teslas were imminent, yet no such system has materialized. Critics remain skeptical, especially amid growing safety concerns and the legal risks associated with testing driverless vehicles on public roads.

Tesla has started the regulatory process necessary to bring its robotaxi services to market. However, the rollout of the much-anticipated “Cybercab”—a vehicle designed specifically for this service—faces potential delays. Reports indicate that Tesla recently suspended shipments of critical parts from China after the U.S. government under former President Donald Trump imposed steep new tariffs of 145%.

Political Distractions Fuel Investor Doubts

Adding to investor anxiety is growing concern over Musk’s apparent split focus. His involvement in political activities, including a leadership role in Trump’s administration and efforts to reduce the federal workforce, has sparked backlash.

This has led to visible unrest, including public protests and vandalism at Tesla showrooms. Such events have been linked to a decline in the company’s brand perception and an increase in trade-ins from disgruntled customers.

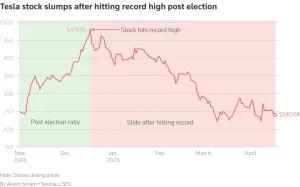

Sales have suffered as a result, particularly in California, Tesla’s most critical U.S. market. The company’s stock has taken a significant hit, tumbling 40% since the start of the year—a loss that has erased over $500 billion from its total market valuation.

Dennis Dick, chief strategist at Stock Trader Network and a Tesla shareholder, believes Musk can still turn things around. “If Elon can shift his focus back to restoring Tesla’s image, the damage to the brand could be repaired,” he said. “But it’s crucial that he dials down the political rhetoric and redirects attention to autonomous driving, robotaxis, and the Optimus robot program.”

Q1 Revenue Holds Steady Despite Delivery Declines

Even as first-quarter deliveries fell sharply, Tesla’s total revenue is expected to remain steady. Forecasts from LSEG estimate revenue at $21.35 billion for the quarter, matching figures from the same period last year. This stability is largely due to increased revenue from regulatory credits and sales from Tesla’s solar and energy storage divisions.

According to Visible Alpha, which surveyed 21 analysts, Tesla’s automotive gross margin—excluding regulatory credits—is projected to fall to 11.83%, down from 13.6% in the previous quarter.

Deutsche Bank’s Edison Yu predicts that Tesla will prioritize boosting delivery volume over maintaining margins. “We’re likely to see more incentives offered, which could dent profitability further,” Yu noted. These incentives may include complimentary charging access or trial access to Tesla’s advanced driver-assist features.

Meanwhile, the company has started offering steep discounts on unsold Cybertrucks, responding to weakening demand for the high-profile pickup. In March, Tesla recalled all Cybertrucks delivered so far to address a flaw with an exterior panel—fueling renewed questions about the vehicle’s reliability and safety.