TRUMP Cryptocurrency Hits All-Time Low Amid Market Turmoil

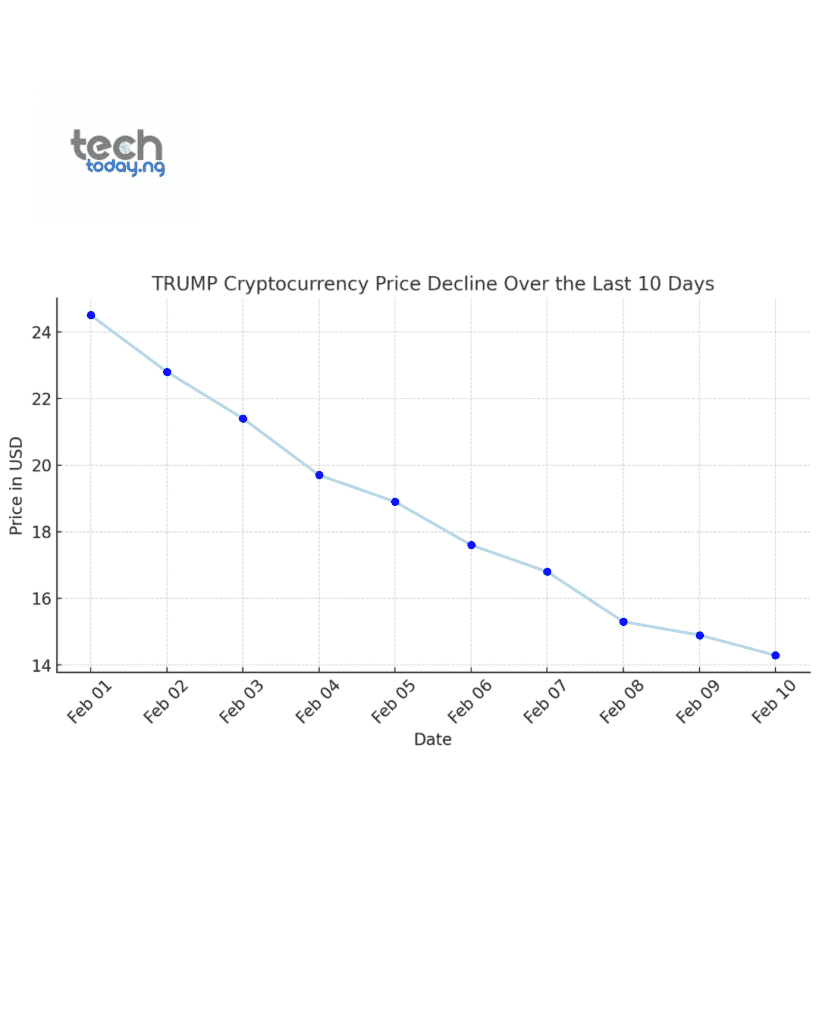

The TRUMP cryptocurrency has taken a significant hit, reaching a new all-time low of $14.29, marking an 11% drop within 24 hours after breaking below the $16.00 support level. The sharp decline reflects growing concerns over the impact of ongoing U.S.-led tariff wars, which have contributed to widespread market volatility and a decline in risk assets, including cryptocurrencies.

Impact of Tariff Wars on Crypto Markets

The drop in TRUMP’s value comes amid intensifying trade tensions initiated by the U.S. administration, particularly in response to tariffs imposed on steel, aluminum, and Chinese imports.

These tariff increases have triggered economic uncertainty, sending shockwaves across global financial markets and prompting investors to pull funds from high-risk assets, such as cryptocurrencies and meme coins.

Market analysts suggest that TRUMP’s decline aligns with a broader bearish trend in the crypto space. With investor sentiment weakening due to geopolitical uncertainties, the digital asset market has faced heavy selling pressure. Bitcoin (BTC) and Ethereum (ETH) have also recorded substantial losses, further exacerbating the downward momentum.

Technical Indicators Signal Further Decline

Technical analysis shows that TRUMP’s Relative Strength Index (RSI) has entered deep bearish territory, indicating continued selling pressure. If the cryptocurrency fails to regain momentum and break above the $19.58 resistance level, it risks dropping below the $10 mark, which could trigger further panic selling and liquidations.

According to on-chain data, the number of wallets holding TRUMP tokens has also declined, suggesting that some early investors may be offloading their holdings amid fears of prolonged market instability. Analysts believe that unless a major catalyst emerges—such as a policy shift or strategic partnerships—the token may struggle to recover in the short term.

Wider Crypto Market Reactions

The TRUMP token is not the only digital asset facing pressure due to economic and regulatory uncertainties. The wider meme coin market, which surged in popularity due to speculative trading and high-profile endorsements, has also seen a significant cooldown in trading volume. Investors are now moving toward more stable assets as risk aversion increases.

Meanwhile, Bitcoin (BTC), the leading cryptocurrency, has dropped below $42,000, reflecting a general downtrend across the digital asset sector. Ethereum (ETH) has also struggled, trading under $2,200 as traders anticipate further regulatory challenges and market instability.

Outlook for TRUMP Cryptocurrency

While some investors remain hopeful for a reversal in TRUMP’s fortunes, others argue that the cryptocurrency’s future depends largely on macroeconomic factors and whether the tariff wars de-escalate. If trade tensions continue to escalate, digital assets tied to political narratives may experience even greater losses.

For now, traders and investors are closely monitoring TRUMP’s price action, as well as broader trends in U.S.-China relations, regulatory developments, and overall crypto market sentiment. With no clear signs of recovery, TRUMP remains in bearish territory, facing one of its worst trading periods since its inception.